All Categories

Featured

Table of Contents

- – Who has the best customer service for Level Te...

- – What is the difference between Fixed Rate Term...

- – What is the best Best Value Level Term Life I...

- – What does Level Premium Term Life Insurance c...

- – How long does Level Term Life Insurance Bene...

- – Who are the cheapest Best Value Level Term L...

Costs are usually less than entire life policies. With a level term plan, you can pick your protection quantity and the policy length. You're not secured into an agreement for the rest of your life. Throughout your plan, you never have to bother with the premium or fatality advantage amounts transforming.

And you can't squander your plan during its term, so you will not obtain any monetary take advantage of your past protection. As with various other kinds of life insurance policy, the expense of a level term policy depends upon your age, protection needs, employment, way of life and health and wellness. Commonly, you'll locate much more economical coverage if you're younger, healthier and less dangerous to guarantee.

Considering that level term premiums remain the same throughout of protection, you'll know precisely just how much you'll pay each time. That can be a large help when budgeting your costs. Level term protection also has some versatility, permitting you to customize your plan with added features. These typically been available in the kind of motorcyclists.

You may need to fulfill details conditions and credentials for your insurance company to enact this rider. On top of that, there may be a waiting period of up to 6 months prior to taking impact. There also can be an age or time frame on the coverage. You can add a youngster biker to your life insurance policy policy so it likewise covers your kids.

Who has the best customer service for Level Term Life Insurance For Young Adults?

The fatality benefit is usually smaller sized, and insurance coverage usually lasts up until your child turns 18 or 25. This motorcyclist might be a much more affordable way to aid guarantee your youngsters are covered as cyclists can often cover multiple dependents simultaneously. As soon as your kid ages out of this insurance coverage, it may be possible to transform the cyclist into a new policy.

The most typical kind of long-term life insurance coverage is entire life insurance coverage, however it has some key distinctions compared to level term coverage. Here's a basic introduction of what to consider when contrasting term vs.

Whole life insurance lasts insurance policy life, while term coverage lasts protection a specific periodParticular The costs for term life insurance coverage are generally lower than entire life coverage.

What is the difference between Fixed Rate Term Life Insurance and other options?

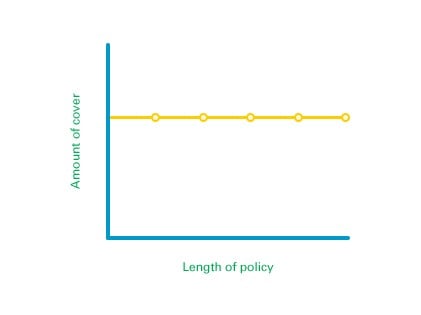

One of the primary functions of degree term protection is that your costs and your survivor benefit do not alter. With reducing term life insurance policy, your costs remain the exact same; however, the survivor benefit amount gets smaller sized with time. For instance, you might have coverage that starts with a fatality benefit of $10,000, which could cover a home mortgage, and then each year, the fatality benefit will decrease by a collection quantity or portion.

Due to this, it's commonly a much more economical kind of degree term coverage., however it might not be enough life insurance for your demands.

After making a decision on a plan, complete the application. If you're authorized, sign the documentation and pay your very first costs.

Lastly, think about scheduling time annually to examine your policy. You might want to upgrade your recipient information if you've had any type of considerable life changes, such as a marital relationship, birth or divorce. Life insurance coverage can sometimes really feel challenging. Yet you don't need to go it alone. As you discover your choices, take into consideration reviewing your needs, desires and concerns with a financial professional.

What is the best Best Value Level Term Life Insurance option?

No, level term life insurance coverage does not have cash value. Some life insurance policy plans have a financial investment function that enables you to construct cash money worth over time. Affordable level term life insurance. A portion of your costs settlements is set apart and can make passion with time, which grows tax-deferred during the life of your insurance coverage

However, these policies are usually considerably a lot more expensive than term protection. If you get to completion of your policy and are still alive, the coverage ends. Nevertheless, you have some options if you still want some life insurance policy coverage. You can: If you're 65 and your coverage has gone out, for instance, you may wish to buy a brand-new 10-year level term life insurance policy policy.

What does Level Premium Term Life Insurance cover?

You may have the ability to convert your term insurance coverage into a whole life policy that will certainly last for the rest of your life. Lots of kinds of degree term policies are exchangeable. That indicates, at the end of your protection, you can convert some or every one of your plan to entire life coverage.

Level term life insurance coverage is a plan that lasts a collection term usually in between 10 and three decades and comes with a degree fatality benefit and level premiums that stay the very same for the entire time the plan is in impact. This suggests you'll recognize specifically just how much your payments are and when you'll have to make them, permitting you to spending plan as necessary.

Degree term can be a wonderful alternative if you're looking to buy life insurance coverage for the first time. According to LIMRA's 2023 Insurance Measure Research, 30% of all adults in the U.S (Level term life insurance for seniors). need life insurance coverage and don't have any kind of policy. Degree term life is foreseeable and budget-friendly, that makes it among one of the most preferred sorts of life insurance policy

A 30-year-old male with a similar account can expect to pay $29 each month for the exact same insurance coverage. AgeGender$250,000 protection quantity$500,000 coverage quantity$1 million insurance coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Typical regular monthly prices are calculated for male and female non-smokers in a Preferred health and wellness category acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy.

How long does Level Term Life Insurance Benefits coverage last?

Rates might differ by insurer, term, coverage amount, health and wellness course, and state. Not all policies are readily available in all states. It's the most inexpensive type of life insurance coverage for the majority of individuals.

It enables you to spending plan and prepare for the future. You can quickly factor your life insurance policy into your budget plan since the premiums never ever change. You can intend for the future equally as quickly due to the fact that you recognize specifically just how much money your loved ones will certainly receive in the event of your lack.

Who are the cheapest Best Value Level Term Life Insurance providers?

This holds true for individuals that stopped smoking or who have a health and wellness problem that fixes. In these cases, you'll generally have to go with a brand-new application procedure to obtain a better price. If you still require insurance coverage by the time your degree term life plan nears the expiration day, you have a few options.

Table of Contents

- – Who has the best customer service for Level Te...

- – What is the difference between Fixed Rate Term...

- – What is the best Best Value Level Term Life I...

- – What does Level Premium Term Life Insurance c...

- – How long does Level Term Life Insurance Bene...

- – Who are the cheapest Best Value Level Term L...

Latest Posts

Fidelity Funeral Insurance

Burial Life Insurance Cost

Mutual Of Omaha Burial Insurance Rates

More

Latest Posts

Fidelity Funeral Insurance

Burial Life Insurance Cost

Mutual Of Omaha Burial Insurance Rates